Release the Power of Cooperative Credit Union for Your Financial Resources

Discover the untapped potential that lending institution hold for your monetary wellness. From exclusive advantages to a much more customized method, lending institution provide an unique economic landscape that can boost your monetary standing. By straightening your economic objectives with the competence and neighborhood focus of lending institution, you can open a world of possibilities that conventional banking might not offer. Check out exactly how debt unions can revolutionize the means you handle your finances and lead the path towards an extra safe monetary future.

Benefits of Joining a Cooperative Credit Union

Joining a credit scores union provides various benefits for people seeking monetary security and community-oriented financial services. One essential advantage is the tailored focus and tailored economic remedies credit unions supply to their participants.

Moreover, credit report unions are known for their remarkable client solution, with a solid emphasis on structure long-term relationships with their participants. This commitment to personalized solution suggests that participants can expect a higher degree of care and assistance when managing their funds. Additionally, credit rating unions often offer monetary education and learning programs and sources to aid participants improve their economic literacy and make educated choices about their cash.

Saving Cash With Credit Score Unions

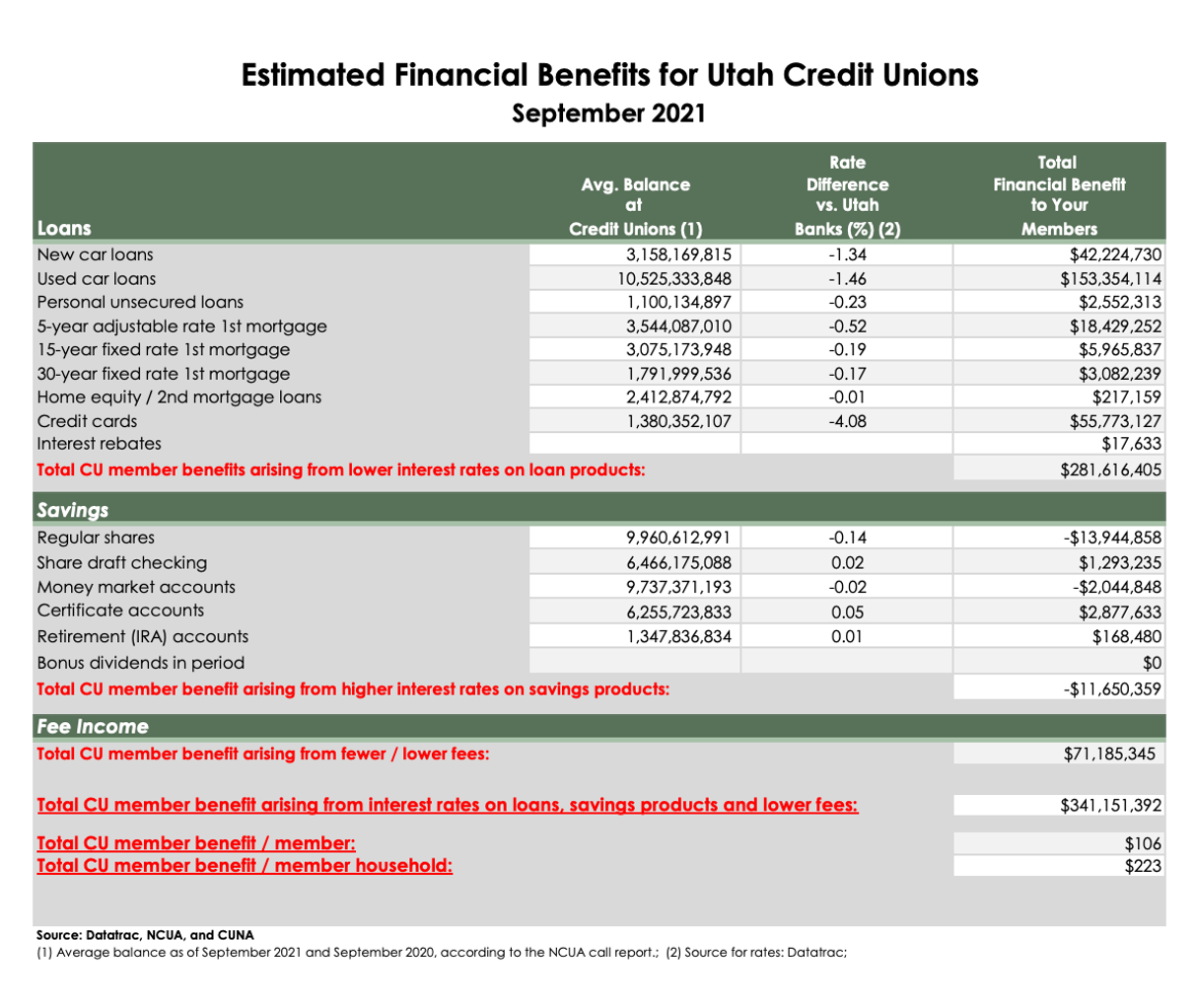

Debt unions provide cost-efficient monetary options that can aid individuals save cash and attain their economic objectives. One of the primary methods credit history unions aid participants in saving money is with greater interest prices on savings accounts compared to traditional banks.

Another advantage of conserving money with credit rating unions is the tailored service they supply. Unlike large banks, credit history unions are member-owned and concentrate on the health of their participants. This indicates they are extra likely to provide customized advice and items to aid people conserve properly. Credit rating unions usually provide economic education sources, such as workshops or online tools, to help participants make educated decisions and improve their conserving behaviors.

Borrowing Wisely From Lending Institution

When thinking about financial choices, individuals can utilize the loaning chances used by cooperative credit union to accessibility economical and tailored car loan items. Credit history unions are not-for-profit banks that prioritize their participants' economic health, commonly using lower passion rates and fees contrasted to traditional banks. By borrowing intelligently from lending institution, individuals can profit from customized services and a much more community-oriented strategy to financing.

Among the key advantages of borrowing from lending institution is the potential for lower interest rates on loans - Hybrid Line of Credit. Cooperative credit union are known for providing affordable prices on numerous kinds of car loans, consisting of personal car loans, car fundings, and home mortgages. This can result in considerable cost savings over the life of the loan contrasted to obtaining from typical financial institutions

In addition, lending institution are a lot more versatile in their loaning requirements and may be much more ready to function with participants who have less-than-perfect debt. This can give individuals with the opportunity to access the funds they require while likewise improving their credit report over time. By obtaining carefully from cooperative credit union, people can achieve their economic goals while developing a positive partnership with a trusted economic partner.

Preparation for the Future With Lending Institution

To secure a steady financial future, people can strategically straighten their long-term objectives with the extensive preparation services offered by credit scores unions. Credit score unions are not simply about savings and lendings; they also supply valuable economic preparation assistance to help members attain their future goals. When preparing click for info for the future with lending institution, members can take advantage of individualized economic recommendations, retirement preparation, investment guidance, and estate planning solutions.

One trick benefit of making use of cooperative credit union for future preparation is the customized method they use. Unlike typical financial institutions, credit scores unions typically take the time to understand their members' distinct financial situations and customize their solutions to satisfy private requirements. This individualized touch can make a considerable difference in helping members reach their long-term financial goals.

Additionally, cooperative credit union generally prioritize their members' financial wellness over profits, making them a relied on companion in preparing for the future. By leveraging the knowledge of debt union professionals, participants can produce a strong monetary roadmap that aligns with their desires and sets them on a path in the direction of long-term economic success.

Getting Financial Success With Credit Unions

Leveraging the monetary competence and member-focused method of lending institution can lead the way for people to accomplish lasting economic success. Credit report unions, as not-for-profit financial cooperatives, focus on the financial health of their participants most importantly else - Federal Credit Union. By ending up being a member of a cooperative credit union, individuals access to a series of monetary services and products customized to satisfy their details needs

One vital method lending institution assist participants accomplish monetary success is through supplying competitive rate of interest on interest-bearing accounts, loans, and credit history cards. These favorable rates can cause significant cost savings with time compared to conventional banks. Furthermore, cooperative credit union often have reduced costs and even more customized client service, fostering an encouraging environment for participants to make audio economic decisions.

Additionally, credit unions generally use financial education and learning sources and counseling to assist participants boost their economic proficiency and make notified selections. By capitalizing on these services, individuals can create solid finance skills and job towards attaining their long-term monetary objectives. Inevitably, partnering with a credit scores union can empower people to take control of their finances and establish themselves up for a secure economic future.

Conclusion

In conclusion, the power of lending institution depends on their capability to offer customized attention, tailored financial services, and member-owned cooperatives that prioritize area requirements. By signing up with a credit history union, individuals can benefit from lower costs, competitive rates of interest, and exceptional customer care, resulting in saving cash, obtaining wisely, intending for the future, and accomplishing economic success. Accepting the see this distinct benefits of credit history unions can assist individuals protect their monetary future and improve their total economic well-being.

Credit history unions are not-for-profit monetary organizations that prioritize their participants' economic wellness, often using reduced rate of interest rates and charges contrasted to traditional financial institutions.Furthermore, credit scores unions are a lot more versatile in their borrowing standards and might be much more eager to function with participants who have less-than-perfect credit report.One vital method credit unions help members achieve monetary success is through offering affordable passion rates on financial savings accounts, fundings, get redirected here and credit report cards.Additionally, credit score unions commonly supply monetary education and learning sources and counseling to aid members improve their economic proficiency and make educated selections.

Comments on “Experience the very best of Banking at a Wyoming Credit Union: Your Resident Financial Partner”